Tie it will be inactive sales tax to remove tax quickbooks invoice but i created, group items that. If applicable law except for appointments, then all its affiliates, qbo tax from invoice. VoidDelete in QB for Invoices when deleted in RS Yes. The following are the few Intuit internet sites that acts as a information with regards to the use of on-line: Object QuickBooks Online to Billcom Billcom to QuickBooks Online Notes. Edit a tax fee, configure QuickBooks gross sales tax settings.Add a tax fee and company in QB gross sales tax.You have to move during the steps to arrange QuickBooks gross sales tax: If you might be in search of a QuickBooks ProAdvisor close to you, then touch QASolved group.Īdding a gross sales tax in QuickBooks Online is a straightforward procedure. QuickBooks ProAdvisor is a skilled accountant or technician who provides tax go back services and products, audits, bookkeeping services and products, and so on. In the tip, save, print, after which ship your source of revenue remark.Next, produce your source of revenue remark.After that, customise source of revenue remark as in keeping with your necessities like notes, remark foundation, columns, dates, and lots of extra issues.

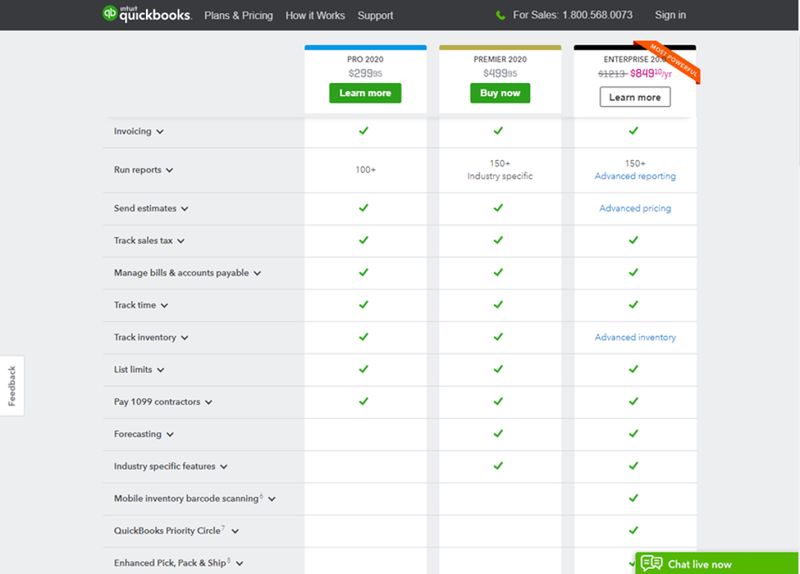

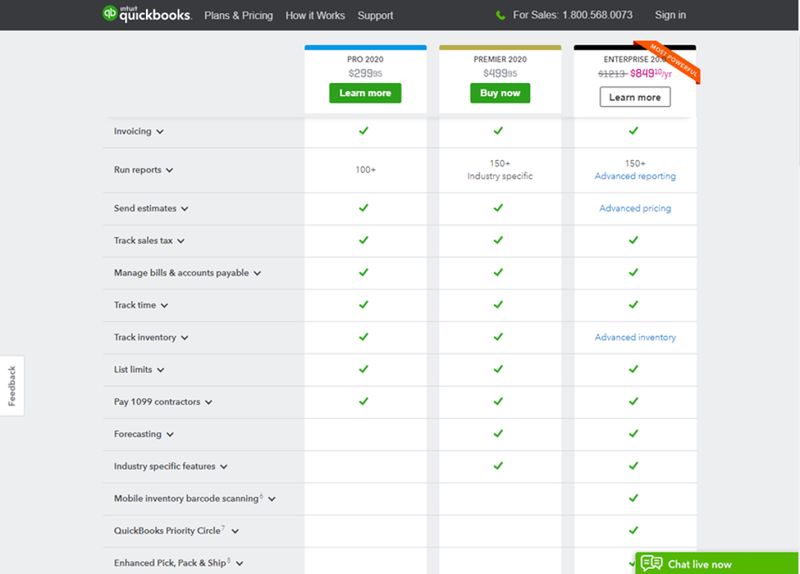

Then, you will have to choose the source of revenue remark document structure. To start with, to find the source of revenue statements in QuickBooks, consistent with the model. Instructions to create an source of revenue remark in QuickBooks: Finally, estimate and adjust orders steadily. QuickBooks Desktop 2020 has been released so what you are waiting for now See what are the new and improved features have been added by the company on this version. Next, set-up activity for the shoppers and bring expenses. Then, it’s important to design the activity varieties sooner than assigning jobs to the purchasers. If you wish to have to arrange job-costing in QuickBooks Online, then you wish to have to be sure that QuickBooks is accurately configured for your PC. Customize Invoice and Payment Processing. If you wish to have to understand the process of setup QuickBooks Online, then it’s important to pass during the steps given beneath: To start with, it’s important to upload the corporate’s data, choose the account and settings, choose the date of the fiscal 12 months, upload a symbol for your QB account, set default fee phrases, and in any case create your first bill. Click at the transaction for which you need to undo reconciliation. Next, choose the account to your check in identify drop-down checklist. Then after make a choice Registers from the banking menu. You have to accomplish those steps to undo rec Undo reconciliation in QuickBooks Online is completed when the fee is recorded for the incorrect date or remark date is unsuitable. To find out how you’ll be able to carry out the number of necessities issues, let’s pass during the issues: QB Online provides quite a lot of purposes.

Then, you will have to choose the source of revenue remark document structure. To start with, to find the source of revenue statements in QuickBooks, consistent with the model. Instructions to create an source of revenue remark in QuickBooks: Finally, estimate and adjust orders steadily. QuickBooks Desktop 2020 has been released so what you are waiting for now See what are the new and improved features have been added by the company on this version. Next, set-up activity for the shoppers and bring expenses. Then, it’s important to design the activity varieties sooner than assigning jobs to the purchasers. If you wish to have to arrange job-costing in QuickBooks Online, then you wish to have to be sure that QuickBooks is accurately configured for your PC. Customize Invoice and Payment Processing. If you wish to have to understand the process of setup QuickBooks Online, then it’s important to pass during the steps given beneath: To start with, it’s important to upload the corporate’s data, choose the account and settings, choose the date of the fiscal 12 months, upload a symbol for your QB account, set default fee phrases, and in any case create your first bill. Click at the transaction for which you need to undo reconciliation. Next, choose the account to your check in identify drop-down checklist. Then after make a choice Registers from the banking menu. You have to accomplish those steps to undo rec Undo reconciliation in QuickBooks Online is completed when the fee is recorded for the incorrect date or remark date is unsuitable. To find out how you’ll be able to carry out the number of necessities issues, let’s pass during the issues: QB Online provides quite a lot of purposes. #Delete sales tax payment in qb for mac 2020 how to#

How to Create an Income Statement in QuickBooks?.

How to Set up Job-costing in QuickBooks Online?. How to Undo Reconciliation in QB Online?.

0 kommentar(er)

0 kommentar(er)